Sum of the years’ digits depreciation is another accelerated depreciation method. It doesn’t depreciate an asset quite as quickly as double declining balance depreciation, but it does it quicker than straight-line depreciation. Depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Accumulated depreciation is recorded in a contra account as a credit, reducing the value of fixed assets. So in summary, depreciation expense reduces net income while accumulated depreciation reduces the carrying value of fixed assets.

Fishing business example

Depreciation is a solution for this matching problem for capitalized assets because it allocates a portion of the asset’s cost in each year of the asset’s useful life. The second scenario that could occur is that the company really wants the new trailer, and is willing to sell the old one for only $65,000. In addition, there is a loss of $8,000 recorded on the income statement because only $65,000 was received for the old trailer when its book value was $73,000. Companies have several options for depreciating the value of assets over time, in accordance with GAAP. Most companies use a single depreciation methodology for all of their assets. Thus, the methods used in calculating depreciation are typically industry-specific.

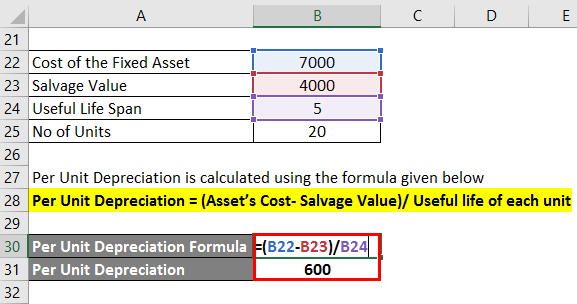

What is the Depreciable Cost Formula?

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence. For book purposes, most businesses depreciate assets using the straight-line method. The difference between the debit balance in the asset account Truck and credit balance in Accumulated Depreciation – Truck is known as the truck’s book value or carrying value. At the end of three years the truck’s book value will be $40,000 ($70,000 minus $30,000). Income statement accounts are referred to as temporary accounts since their account balances are closed to a stockholders’ equity account after the annual income statement is prepared. To illustrate the cost of an asset, assume that a company paid $10,000 to purchase used equipment located 200 miles away.

Declining Balance

- The double declining balance method is often used for equipment when the units of production method is not used.

- Our PRO users get lifetime access to our depreciation cheat sheet, flashcards, quick tests, business forms, and more.

- Depreciation is an accounting practice used to spread the cost of a tangible asset, such as a vehicle, piece of equipment, or property, over its useful life.

It would, however, be impractical (and of no great benefit) to calculate and re-calculate the extent of this loss over short periods (e.g., every month). All assets have a useful life and every machine eventually reaches a time when it must be decommissioned, irrespective of how effective the organization’s maintenance policy is. Accountants often say that the purpose of depreciation is to match the cost of the truck with the revenues that are being earned by using the truck. Others say that the truck’s cost is being matched to the periods in which the truck is being used up.

The formula of Depreciation Expense is used to find how much asset value can be deducted as an expense through the income statement. Depreciation may be defined as the decrease in the asset’s value due to wear and tear over time. E.g., depreciation on plant and machinery, furniture and fixture, motor vehicles, and other tangible fixed assets. Depreciation allows businesses to spread the cost of physical assets over a period of time, which has advantages from both an accounting and tax perspective. Businesses have a variety of depreciation methods to choose from, including straight-line, declining balance, double-declining balance, sum-of-the-years’ digits, and unit of production . This allows the company to match depreciation expenses to related revenues in the same reporting period—and write off an asset’s value over a period of time for tax purposes.

Introduction to Depreciation Expense in Accounting

You installed a fence around the entire plot of land, which falls under the 15-year property life. The initial cost of the fence was $25,000, and you think you can scrap the wood for $3,000 at the end of its useful life. Now, let’s assume you run a large fishing business that sets out on the Bering Sea every summer to capture fresh salmon. You can calculate the asset’s life span by determining the number of years it will remain useful.

In turn, depreciation can be projected as a percentage of Capex (or as a percentage of revenue, with depreciation as an % of Capex calculated separately as a sanity check). The depreciation expense can be projected by building a PP&E roll-forward schedule based on the company’s existing PP&E and incremental PP&E purchases. While technically more “accurate”, at least in theory, the units of production method is the most tedious out of the three and requires a granular analysis (and per-unit tracking). Future years’ results will vary as the number of units actually produced varies. This would continue each year until the amount of the deduction is less than or equal to the amount that would be obtained using the straight-line method, at which point it switches over to that method.

For example, the total depreciation for 2023 is comprised of $60k of depreciation from Year 1, $61k of depreciation from Year 2, and then $62k of depreciation from Year 3 – which comes out to $184k in total. In our hypothetical scenario, the company is projected to have $10mm in revenue in the first year of the forecast, 2021. The revenue growth rate will decrease by 1.0% each year until reaching 3.0% in construction job costing 2025. Capex can be forecasted as a percentage of revenue using historical data as a reference point. In addition to following historical trends, management guidance and industry averages should also be referenced as a guide for forecasting Capex. Capital expenditures are directly tied to “top line” revenue growth – and depreciation is the reduction of the PP&E purchase value (i.e., expensing of Capex).

Unlike the account Depreciation Expense, the Accumulated Depreciation account is not closed at the end of each year. Instead, the balance in Accumulated Depreciation is carried forward to the next accounting period. After the truck has been used for two years, the account Accumulated Depreciation – Truck will have a credit balance of $20,000. After three years, Accumulated Depreciation – Truck will have a credit balance of $30,000. Each year the credit balance in this account will increase by $10,000 until the credit balance reaches $70,000.